Else Nutrition Holdings Offers A Ground Floor Entry Into A Baby Formula Disruptor

Else Nutrition Holdings Inc. (OTCQB:BABYF) started trading on the TSX Venture Exchange only in July of 2019. It became quoted on OTCQB in December 2019.

The company is an Israeli business co-founded by three executives, who, in the past, were employees of large manufacturers of baby formula. Hamutal Yitzhak, the CEO, was the head of Infant nutrition for Abbott Labs (ABT) in Israel. Michael Azar, currently the CTO, is a former CEO of Materna, a company acquired by Nestle (OTCPK:NSRGF). Uriel Kesler, the COO, was a General Manager PL Infant Formula at Promedico Healthcare Group.

The production launch of the first-ever plant-based toddler formula is to start late July or early August. The entry below $1 is an attractive opportunity for greenfield investors, who should acknowledge standard risks associated with achieving marketing success, delivering first sales, revenue streams, scaling up, and finally, the company's ability to manage the brand and infrastructure effectively.

The potentialThe reason for the investment is the value potential built on the drive toward the quality of baby food and the presence of healthy options. Products marketed for babies had not experienced a change for over 100 years, and they are far from being healthy when applied to today's standards.

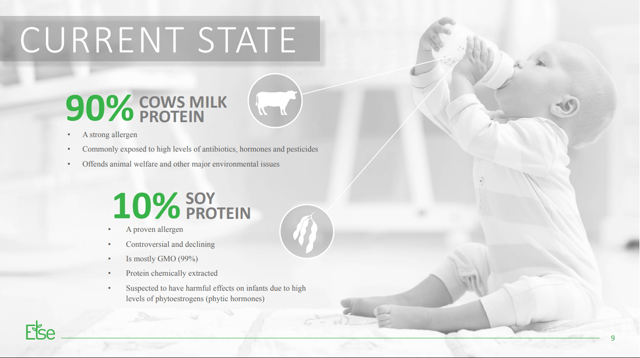

Baby formula today. The company's presentation, December 2019.

Almost everyone heard about Beyond Meat (BYND). In many ways similar, the idea here is to replace the existing baby formula with a plant-based alternative. But also create sustainable, organic, vegan, and in comparison to existing milk and soy-based products, healthy choice for parents.

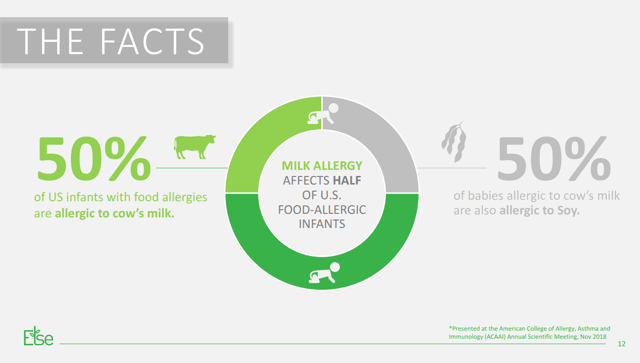

Consumer facts. The company's presentation, December 2019.

Today, BABYF has a market capitalization of $65M, in comparison to BYND's over $8B. A variety of reasons contribute to the condition. The company is not well known to the market. It has no product available yet; therefore, there are no revenues. Listing on the Canadian venture exchange or OTCQB does not create a lot of visibility. The price below $1 is prohibitive for most institutions.

On the other hand, those very conditions produce an attractive ground-level entry, before the success and the recognition takes place. The potential is incredible but heavily dependent on management's ability to execute and the qualities of the product.

So what is unique about the product?

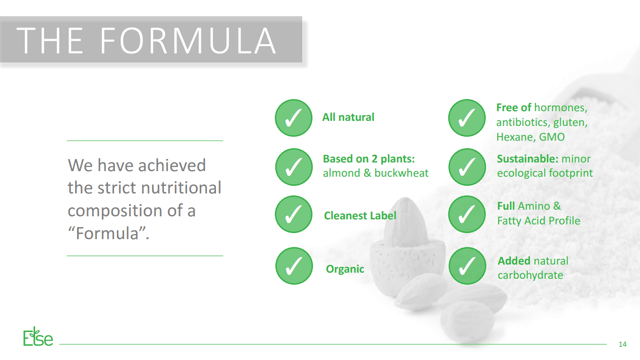

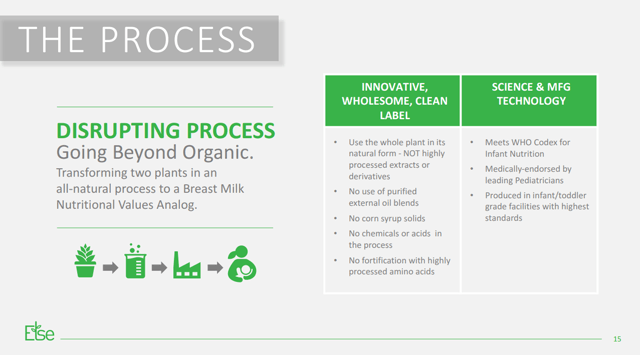

In an entirely natural process, the company transformed two plants almond, and buckwheat, into a product analogous to breast milk nutritional values.

First-ever toddler plant-based formula - Else' website

First-ever toddler plant-based formula - Else' website

The slide below illustrates additional details. The presentation dated back to December 2019, describes all advantages of Else's toddler formula over existing products. It should be reviewed by anyone interested in investing in the company.

A "formula." The company's presentation, December 2019.

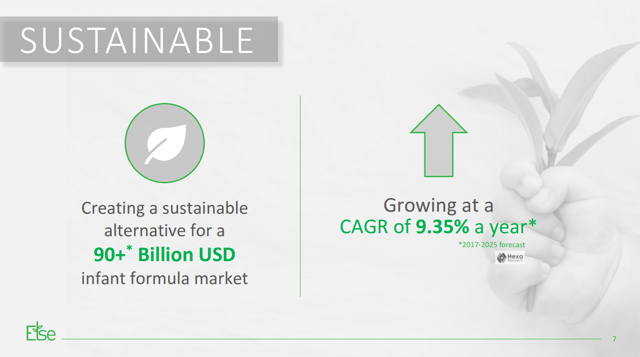

When Else starts the production, it will be entering a global industry worth $90B a year, growing at 9.35% CAGR.

Baby Formula Market, data from Hexa Research. The company's presentation, December 2019.

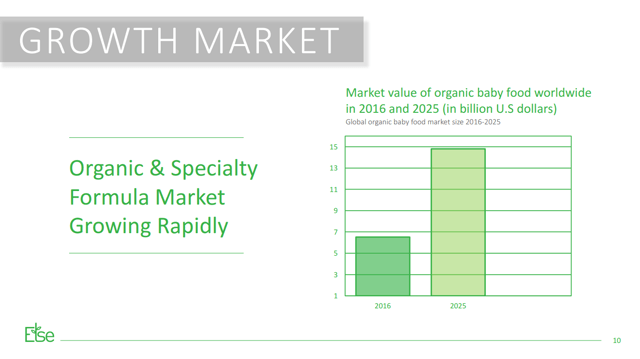

The organic and specialty segment within it is expected to grow to about $15B by 2025.

Growth for organics and specialty products. The company's presentation, December 2019.

To rationalize potential for Else, I will assume the market share worth $100M in sales. A conservative Price/Sales ratio of 10 would result in a $1B market capitalization. Else would need to sell 3.12M canisters per year at $32 per canister, a price already set by the company, to get to this milestone. Assuming that one family per year would use 26 canisters, Else would need 120 thousand families as customers. There are approximately 23M children under the age of 5 in the US. Estimating that 20% are toddlers, Else would be looking at 4.6M consumers.

Just at 3% penetration in the US alone, Else would reach a goal of $100M in sales per year.

A $1B market capitalization would produce a $12.5 per share versus $0.83 today, using 80M shares outstanding. Admittedly, there is quite a large amount of warrants issued. When exercised, it would produce cash but would also add as many as 50M shares. At the full dilution of 130M shares, $7.70 per share or a return of 830% could be achieved.

Naturally, $100M is not a limit but perhaps only a first target.

Another example of how to get the first $100M in sales are opportunities for China. A country with a $25B demand for a baby formula where Nestle is having around 13% of the market.

Else seems to be positioning itself to access this market in cooperation.

NewH2 Limited, a wholly-owned subsidiary of Health and Happiness (H&H) International Holdings Ltd. (1112.HK), a company worth $24B on a Hong Kong Stock Exchange, made a strategic investment in Else in March 2020. While the CAD $8M is small, much more comes from future agreements. The memorandum of understanding is for the future distribution of non-dairy non-soy baby formula and children nutrition drinks in China, but also France, Hong Kong, Australia, and Italy. NewH2 has also secured a right to participate in future financings to hold 11.15% of the company. Before the investment, the company's executives owned 51% shares outstanding. Under those circumstances, there is no surprise the shares are thinly traded in Canada and on the OTCQB board, averaging some 187K per day.

The product qualities and production. Company's presentation. December 2019

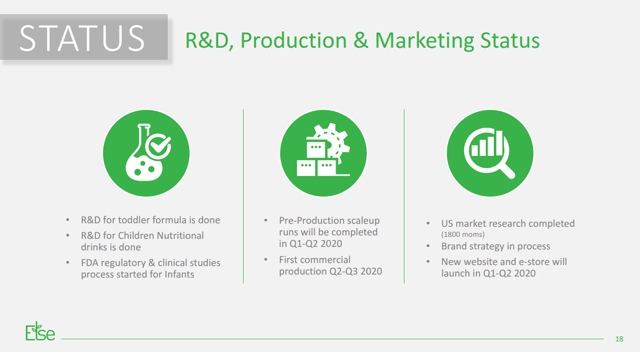

To conclude on the product, Else has taken steps to protect its intellectual property. There are 20 patents granted, including the USA, Japan, and Australia. Patents are also pending in 66 countries. The company is making progress on the process to get FDA approval for the infant formula (0-12 months) versus toddler formula (12 -36 months), the product being ready for sale in the next two months. There are plans to roll out toddler drinks soon.

It is my belief the incoming events will slowly unravel this opportunity.

Marketing for Upcoming Product LaunchElse is engaging in a variety of activities to market the product. Recently Else hired Covet PR, a national U.S.-based public relations firm devoted to food, beverage, beauty, and lifestyle brands. Covet will support the launch of Else products into the US marketplace in Q3-2020. Covet's client roster includes leading wellness brands, such as Beyond Meat, Banza, Kashi, Once Upon a Farm, and many other better-for-you consumer product companies.

Product Launch DateCOVID-19 pandemic had a limited impact on the company but has caused an approximate two-month delay in product launch, which is currently scheduled for late July or early August 2020. The agreement with a leading U.S.-based organic baby formula manufacturer must be finalized before production starts. Based on the company's update from May 22nd, this will be done in June.

Status of the business. Company's presentation. December 2019

ConclusionThe company reported on March 26th, C$10M in cash, and no debt. It also declared, with the money, it could operate in all aspects of the business for over a year. If the product takes off and sales will materialize, Else Nutrition's growth potential will be stacked against other plant-based producers, like BYND, and those valuations are rich. The stock price appreciation would be expected. Share price increases driven by a variety of developments with the most measurable revenue can lead to listing on the big exchange, and much higher investor interest.

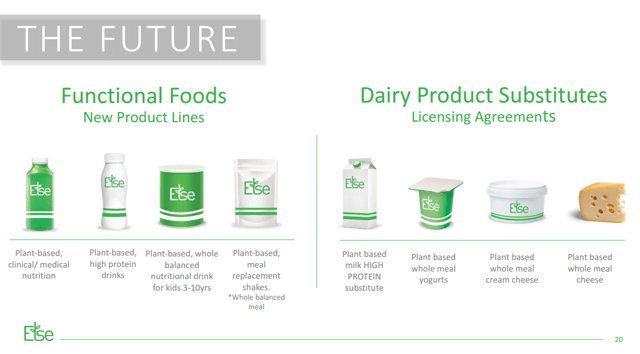

Future product lineup. Company's presentation. December 2019

As every journey starts with the first step, the first step is just being made by Else Nutrition. I recommend the company to an investor who can acknowledge the risks of the startup. Placing a small investment with a buy under a dollar secures a front seat view to the potential for high returns in a timeline of three years.

Disclosure: I am/we are long BABYF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Komentar

Posting Komentar